Although it has been difficult for Bitcoin (BTC) to rise above $70,000, altcoins have recently made significant market gains. On-chain signs point to a significant decline in trade interest in Bitcoin, which may indicate an impending price collapse.

Significant Decline in Bitcoin (BTC) Transaction Volumes

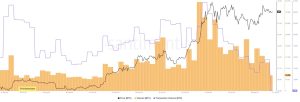

The volume of BTC transactions has reached an all-time low, indicating a dramatic change in the market’s dynamics. The volume of on-chain transactions and spot trading for Bitcoin have both drastically decreased, with investors mainly interested in ETFs and derivatives. With these financial products, speculative demand is increasingly driving the BTC market.

It’s interesting to note that BTC’s seven-day trading volume has fallen to less than $14 billion, a level last seen in 2023, when its price was less than $30,000.

The graph also shows a notable drop in interest in trading BTC and on-chain transaction volumes, which are noticeably low. In contrast to the 1.79 million BTC transferred in October 2023, despite equal trading volumes and half the price, the network recorded only 722,000 BTC moved in seven days.

According to 10x Research, the size of the cryptocurrency industry has decreased to $50 billion along with Bitcoin, and financing rates are only slightly positive, indicating little interest. Data on inflation and Federal Reserve policy are the key elements that could drive Bitcoin to new all-time highs.

The Bank of Canada may start a global cycle of rate reductions on June 5, potentially creating a precedent for the Federal Reserve. In addition, a lower number—roughly 3.3%—must be reported in the U.S. inflation report on June 12 for Bitcoin to rise.

Good Signs to Monitor

The market for BTC derivatives is doing well, and there is much interest in Bitcoin ETF, even though spot trading activity is still slow.

Since their launch in January 2024, the authorized BTC spot ETFs have shown significant demand. These ETFs have generated a total trading volume of $12 billion during the last seven trading days, similar to the spot volume of Bitcoin on cryptocurrency exchanges. This suggests that trading regulated and custodial exchange-traded funds is becoming more popular than Bitcoin.

Whales may be removing their coins from exchanges expecting higher prices, as evidenced by a notable decline in BTC exchange balances. With 88,000 BTCs removed from exchanges in the last month, just 2.5 million coins are now available, the fewest since March 2018. Beginning on May 15, this trend of exchange outflows corresponded with the 45-day period that followed the requirement for U.S. registered investors managing over $100 million to file a 13F report at the end of each quarter.