The price of Bitcoin has declined today for the fourth day in a row, closing below $60,000. Meanwhile, the U.S. Spot Bitcoin ETFs showed strong momentum. Notably, several market observers have suggested that the recent slow trading of the U.S. Spot Bitcoin ETF is a significant factor contributing to the current decline in the price of BTC.

Nevertheless, given that the U.S. Bitcoin ETF has continued to rise this week, it seems that additional variables are at work.

For Four Days, U.S. Spot Bitcoin ETF Saw Inflows

The decline in Bitcoin, which saw it go below the $60,000 threshold, resulted from the slow trading of U.S. Spot Bitcoin ETFs. The ETFs have, meanwhile, seen upward momentum for four days running despite this price decline, suggesting a complex interaction of market dynamics. BlackRock’s IBIT has made a sizable contribution to the latest surge.

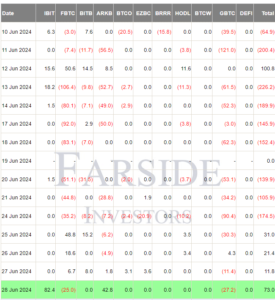

Data from Farside Investors indicates an inflow of $73 million into the U.S. Spot Bitcoin ETF market. A massive $82.4 million was pumped into BlackRock’s IBIT ETF, marking the company’s first notable inflow since June 20. This inflow is noteworthy since it contrasts with withdrawals from other significant Bitcoin ETFs.

To put things in perspective, two historically top-performing Bitcoin ETFs, GrayScale’s GBTC and Fidelity’s FBTC, announced withdrawals of $27.2 million and $25 million, respectively. However, BlackRock’s sizable inflow and extra contributions from Ark 21Shares’s ARKB, which witnessed an inflow of $42.8 million, offset the losses.

This capital redistribution, however, points to a change in investor strategy in favor of ETFs with growth potential and resilience. In addition, despite the market’s uneven performance generally, the recent inflows show rising investor trust in Bitcoin ETFs.

Weekly Trends Indicate Contrary Attitude

For Bitcoin ETFs, the week has been tumultuous. It was highlighted by a notable outflow of $174.5 million on June 24, which created a demanding atmosphere for the entire week.

Interestingly, $137.2 million was deposited during the next four days, resulting in a net outflow of $37.3 million for the week. These numbers show a mixed but generally positive state of the market.

Meanwhile, the four-day winning run points to a possible rebound and durability in the Bitcoin ETF market, powered by well-timed investments and wise capital reallocations. Furthermore, the difference between the initial outflow and the ensuing inflows suggests that the market is dynamically sensitive and that investors are ready to seize new possibilities.

The performance of Bitcoin’s exchange-traded funds (ETFs) provides a crucial gauge of investor mood and the state of the market as its price changes. As of this writing, the price of Bitcoin has dropped by around 1.5% to $60,668. The cryptocurrency peaked at $61,720.31 in the last 24 hours. CoinGlass data indicates that over that same period, BTC Futures Open Interest dropped by more than 2% to $31.62 billion.