The Bitcoin price began the week on a bullish tone, following negative momentum on Tuesday, May 7. Notably, several factors have caused the price of the biggest cryptocurrency, such as market share and other significant altcoins, to experience volatility in recent weeks. For example, the sentiment has been affected by the notable withdrawal from the U.S. Spot Bitcoin ETF.

Now, let’s examine the variables that have affected Bitcoin’s price thus far and speculate on its future performance.

Factors Affecting Bitcoin Price:

This year, the U.S. Spot Bitcoin ETF approval, the Fed’s policy rate stance, and the Bitcoin halving all significantly impacted the price of Bitcoin. Here is a summary of the year.

Hype for Bitcoin ETFs

Since last year, the price of Bitcoin has been rising due to market anticipation for the Bitcoin ETF. Notably, the approval of the U.S. Spot Bitcoin ETF in January has reinforced investors’ trust. Furthermore, the strong inflow into the investment vehicle has also bolstered market sentiment.

In the meantime, the price of Bitcoin reached an all-time high in mid-March due to the tremendous success of the Bitcoin ETFs. In addition, the recent approval of the Spot ETF in Hong Kong has increased confidence even more, indicating the growing institutional trust in the industry.

Interest Rate of the Federal Reserve

The Federal Reserve’s policy rate stance has also affected the mood thus far this year. To put things in perspective, the market was pricing in about five rate reductions this year, along with a slowdown in inflation.

However, the economic data has shown that inflation has remained robust while dampening anticipation about prospective rate reductions this year. Many analysts now predict that there will be one or two rate cuts this year. Furthermore, some have also staked their claim that the policy rates will remain unchanged in 2024.

Bitcoin Halving

The Bitcoin Halving is one of the critical events the market was waiting for in 2024. Given its possible impact on the price of Bitcoin in prior events, the recent halving event has bolstered the confidence of market participants thus far.

In the past, the Bitcoin Halving event has caused the price of BTC to rise significantly and reach a record high, considering that the market was optimistic about the lead cryptocurrency as well. However, numerous market gurus projected short-term instability after the halving while retaining an upward trend for the long run.

Now that we have reviewed some key elements that have considerably impacted BTC’s performance let’s examine how Bitcoin prices might behave in the following days.

Will the Price of Bitcoin Stay Consistent in August?

Rekt Capital, a prominent crypto market analyst, provides insights into Bitcoin’s potential peak in the current cycle. Based on past patterns, he predicts that the peak of Bitcoin might occur between mid-December 2024 and early March 2025.

He added that the cycle’s continued slowdown might cause it to resynchronize with more conventional halving cycles. As Bitcoin assembles, the possibility of stability and resynchronization grows, which could affect its peak duration.

The analyst highlights that Bitcoin’s performance beyond old All-Time Highs has historically lengthened, suggesting a longer Bull Market Peak timeframe. With these variables in mind, investors anticipate stability and possibly peak adjustments in the coming months, influencing Bitcoin’s price trajectory in August 2024.

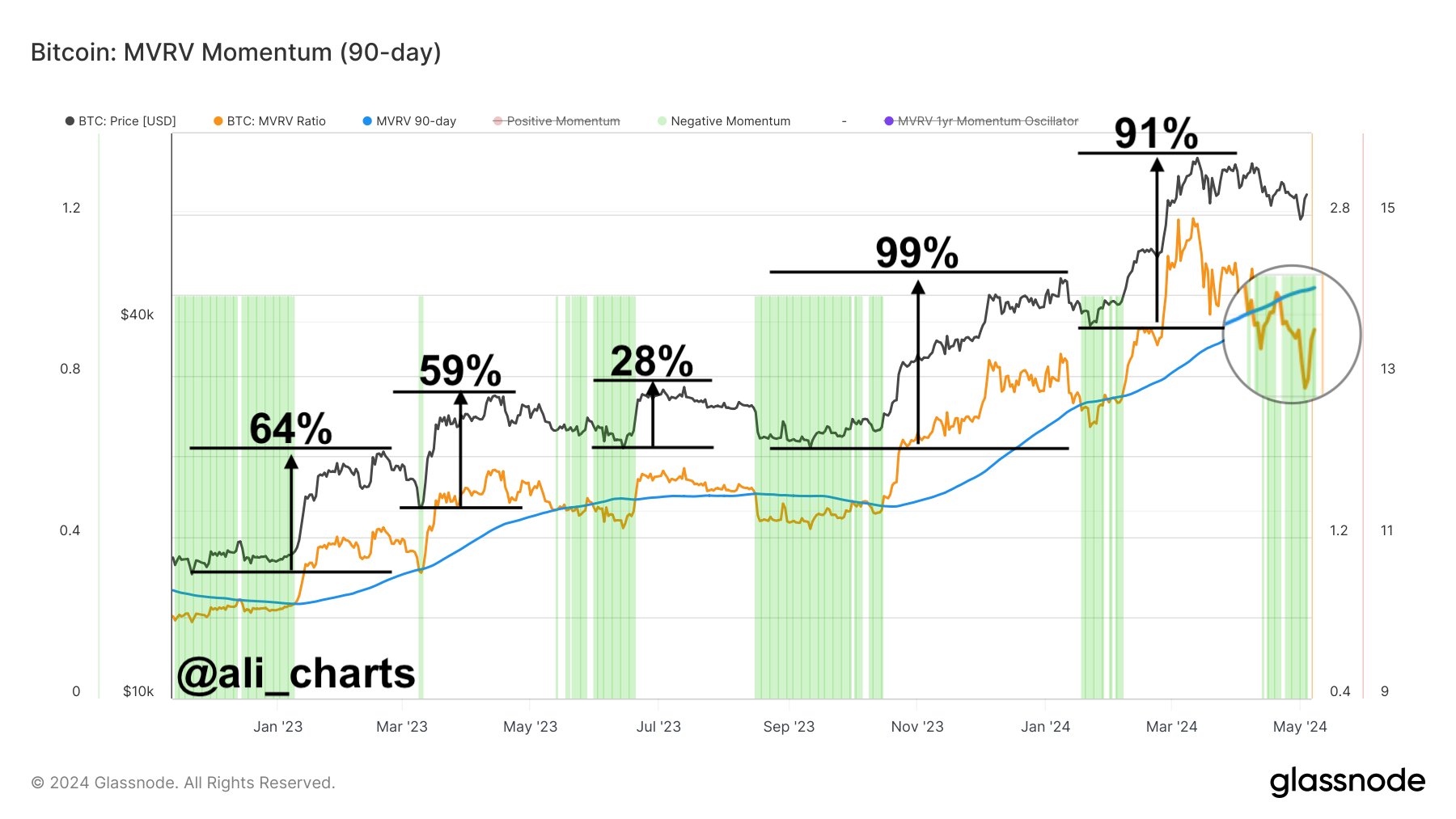

Furthermore, according to Ali Martinez, another market expert, even though the price of Bitcoin has increased recently this week, the “MVRV 90-Day Ratio” indicates that it is still in the “prime buy zone.” This has also increased investors’ confidence in the likelihood of stability in Bitcoin’s trajectory in the upcoming days.

Simultaneously, the recent U.S. Job data showed that the inflation pressure has cooled. However, it still stayed above the Fed’s 2% target range. Some have raised their bets over a potential rate cut in July. Notably, if this occurs, it may improve investor confidence and support the stability of Bitcoin in August.

Meanwhile, as of writing, the Bitcoin price was down 1.10% and traded at $63,585.38, while its trading volume rose 67.61% to $30.56 billion. However, the crypto has achieved a high of 65,494.90 in the recent 24 hours.