Before the highly anticipated FOMC meeting, there was a notable surge in Bitcoin sales, as on-chain data indicated that miners were selling their holdings rapidly. With a market capitalization of $1.328 trillion, the price of Bitcoin (BTC) is 1.5% lower at $67,400 as of publication.

Rises in Bitcoin Miner Capitulation

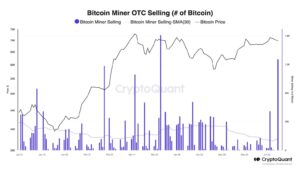

Julio Moreno, Head of Research at CryptoQuant, has noticed notable indications of Bitcoin miner surrender. On Monday, 1,200 Bitcoin were sold by miners, the highest amount of Bitcoin sold per day since late March.

The fact that these trades were made over-the-counter (OTC) rather than on exchanges suggests that miners are choosing to make sizable, covert deals that delay market prices. Miners’ Bitcoin OTC desk balances increased by 54,000 BTC this month, hitting a record high.

The rise in Bitcoin transfers to OTC desks implies that miners might be getting ready to liquidate more of the cryptocurrency, maybe because they are worried about future price declines or need cash. Many mining businesses and individual miners have expressed that they cannot sustain profitable operations after the recent halving, which could result in a potential exodus from the industry.

Will Bitcoin Fall to $62,500?

Willy Woo, a Bitcoin analyst, has suggested that the current liquidations could lead to more price declines. According to Woo, to unload the remaining speculative holdings, Bitcoin may fall to $62,500 if the subsequent wave of long liquidations continues on this path. Woo stressed that before there can be any meaningful upward rise again, the “degen” open interest in futures bets must be liquidated.

The Scalping Pro claims that Bitcoin has seen another rejection from its range high. Since March, the cryptocurrency’s price has been bouncing between $60,500 and $71,500; this is the fourth time that the top boundary of this range has been rejected.

The analyst points out that Bitcoin must sustain this level of support to prevent future drops, as it is located close to the mid-range at $65,000.