The biggest cryptocurrency in the world, Bitcoin, is still being sold off by some investors as they become uneasy in anticipation of the Fed’s decision to lower interest rates. The price of Bitcoin has plummeted by 2% more in the past day, breaking below $68,500.

Interest rates will remain higher than anticipated by the Fed

The European Central Bank and the Bank of Canada reversed course last week by lowering interest rates. But given the positive jobs report last week, it is improbable that the Federal Reserve will take a similar step.

March saw a record high of $73,798 for Bitcoin due to inflows into US exchange-traded funds specifically for that purpose. Since then, though, it has had difficulty reaching new heights. Concerns about interest rates staying high for a long time could be reaffirmed by the Federal Reserve’s forecast on Wednesday and the upcoming inflation statistics, making the market more difficult for speculative assets like cryptocurrencies. Anand Gomes, a co-founder of the derivatives platform Paradigm, stated in an interview with Bloomberg:

“No news is bad news in crypto. The market is like a junkie that constantly needs bullish news to stay up. So when there is none, the path of least resistance is lower.”

Is There Still Pain for Bitcoin?

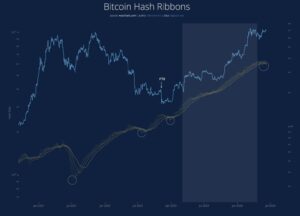

According to Bitcoin researcher Willy Woo, the recent halving event is the reason behind Bitcoin’s unusual miner capitulation. This procedure gets rid of the weaker miners, who then sell off their Bitcoin holdings. Woo said that after these sell-offs, the price of Bitcoin usually rises again.

Woo warns, meanwhile, that excessive speculative interest in BTC futures markets needs to clear away before a price spike can occur. He underlined that “liquidations need to happen before a pump.”

Conversely, following 19 days of robust inflows, the Bitcoin ETFs saw their first withdrawals. A net outflow of $64.9318 million was recorded in Bitcoin spot ETFs on June 10, the first net outflow in 19 days of strong inflows.

The $39.5366 million Grayscale ETF (GBTC) had a notable one-day outflow. On the other hand, the BlackRock ETF (IBIT) and Bitwise ETF (BITB) showed inflows of $6.3433 million and $7.5910 million, respectively.

🚨 $BTC #ETF Net Inflow June 10, 2024: -$65M!

• The net inflow turned negative after being positive for 19 consecutive trading days.

• The single-day inflow of #BlackRock (IBIT) dropped dramatically from $168M to only $6.3M.

• #Grayscale (GBTC) has maintained an outflow of… pic.twitter.com/nZcO8CbkTV

— Spot On Chain (@spotonchain) June 11, 2024