The price of BTC, the world’s biggest cryptocurrency, has dropped to $68,500 after losing support at $71,000, putting significant selling pressure on the market as a whole. At the time of writing, the market capitalization of BTC is $1.37 trillion, and its current price is $69,404.43.

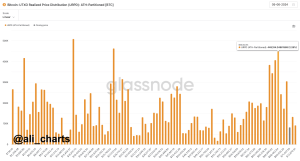

Record High for Bitcoin Hedge Fund Net Shorts

According to analyst Zerohedge, net short positions for Bitcoin hedge funds have significantly risen, setting a new high.

“Huge increase and a new record high in Bitcoin hedge fund net shorts,” said Zerohedge. This will look like amateur hour when it breaks for VW/GME.

Big jump and new record high in Bitcoin hedge fund net shorts.

When this snaps, it will make Volkswagen/GME look like amateur hour https://t.co/86QzbvPIFE pic.twitter.com/b9ZAq1eJSf

— zerohedge (@zerohedge) June 7, 2024

The increase in net shorts points to a negative attitude among hedge funds and the possibility of considerable market volatility should these positions be forced to unwind. The circumstances resemble other short squeezes, like those involving Volkswagen and GameStop (GME), suggesting that the Bitcoin market may undergo a comparable drastic change.

When the meme stock rally ended, BTC and the entire crypto market crashed. As soon as Roaring Kitty launched on Friday, GameStop’s (NYSE: GME) share price plummeted by a whopping 41%.

Will Bitcoin’s Price Continue to Correct?

Cryptocurrency analyst Ali Martinez has found a crucial support level for Bitcoin, which is significant for the cryptocurrency’s future growth.

Martinez said, “BTC’s most important support level is currently at $68,500! If Bitcoin stays at this level, only upwards will be possible. Martinez asserts that the $68,500 support level must be held for Bitcoin to continue rising.

Long-term bullish tendencies usually result in significant declines. Historical evidence suggests that a quick and severe bearish wave frequently follows a protracted bullish phase. According to analyst Alan Santana, this bearish wave can develop two to three times faster than the previous bullish rise.

He clarified: “Investors are more prone to pull out soon when they believe the market’s upward potential has been reached. In contrast to the slow accumulation during a bull market phase, the sell-off during a correction occurs quickly, resulting in a sharp collapse.