The price of Bitcoin has been under significant selling pressure this week, as seen by the two days in a row that the Bitcoin ETFs have had withdrawals following 19 days in a row of inflows. The total withdrawals US Bitcoin exchange-traded funds reported increased to $200 million on Tuesday, June 11.

Volumes Traded in Bitcoin ETFs Increase

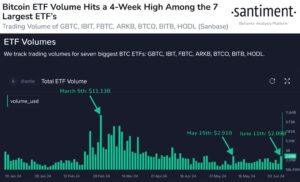

Santiment data indicates that the volume of trading in Bitcoin ETFs has increased to the highest level since May 15. This rise in the top seven largest ETFs suggests the possibility of a price change. According to analysts, the current spike in volume is probably a reaction to a dip-buying opportunity, a sign of rekindled investor enthusiasm and activity in the market.

US Bitcoin spot ETFs saw a $200 million net outflow on June 11, the second day in a row of withdrawals. A total of $121 million was lost in a single day on Grayscale’s GBTC alone. As a result, the combined net asset value of Bitcoin spot ETFs has decreased to $59.227 billion from $60 billion.

Bitcoin Price to Rise Again?

Santiment notes that there have been more buy calls on social media following Bitcoin’s latest decline below $67,000. In the past, increased panic and terror have been associated with sell calls, beginning to reduce the gap on purchase calls and frequently resulting in a rally in bitcoin prices.

The Consumer Price Index (CPI) report for May 2024 is scheduled to be released at 12:30 p.m. UTC (eleven hours from now). Analysts currently expect a gain of 3.4% YoY or 0.3% MoM.

Suppose the actual numbers are less than anticipated. In that case, this might indicate a decrease in inflation and increase the likelihood that bitcoin prices would rise. On the other hand, if the figures come in higher than anticipated, it might be a sign of persistent inflation worries, which might cause the value of cryptocurrencies to decline.

Strong selling pressure on the price of Bitcoin is expected ahead of the FOMC meeting due to the surrender of Bitcoin miners. If the price of Bitcoin falls below $67,000 in the upcoming weeks, it may decline an additional 5-8%.