This week, substantial withdrawals from U.S. Spot Bitcoin ETFs have contributed to the ongoing battle over Bitcoin’s price. According to data from Farside Investors, these ETFs saw a $545 million total outflow this week, raising questions about Bitcoin’s short-term performance. Additionally, given that the stock market was closed on June 19 owing to the Juneteenth holiday, it’s important to note that the U.S. Spot Bitcoin ETF has seen an outflow in just four trading days this week.

The U.S. Spot Bitcoin ETF saw a $545 million withdrawal

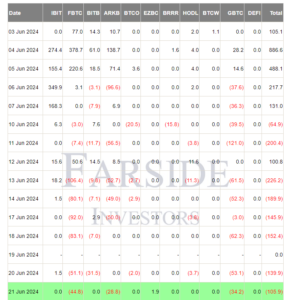

According to the most recent statistics from Farside Investors, the U.S. spot Bitcoin ETFs saw a noteworthy outflow of $545 million this week, indicating increased investor nervousness. Interestingly, even if the price of Bitcoin briefly increased over the previous day, it remained negative.

In the meantime, the withdrawals show that the market is generally bearish. Due to the Juneteenth holiday, there were notable withdrawals over four trading days. The lowest single-day outflow was reported on Friday, June 21, at $105.9 million.

The June 21 withdrawals were led by a $44.8 million withdrawal from Fidelity’s FBTC. Grayscale’s GBTC and ARK 21Shares Bitcoin ETF (ARKB), which saw withdrawals of $34.2 million and $28.8 million, respectively, trailed closely behind. These numbers highlight a general downward trend in investor confidence for several significant ETFs.

Meanwhile, investors and market analysts are concerned about this large cash withdrawal from Bitcoin ETFs. The withdrawals coincide with evidence of weakening in both Bitcoin’s price and trading volume, raising doubts about the cryptocurrency’s near-term prospects. As investor sentiment wanes, the market’s response to these withdrawals may signal future price falls.

Market experts predict that Bitcoin will drop to $60K

In conjunction with a slowdown in Bitcoin trading activity, significant withdrawals from Bitcoin ETFs have sparked conjecture about a potential decline in price. Rekt Capital, a well-known cryptocurrency analyst, has issued a warning, stating that Bitcoin might drop further lower in the days ahead. He predicts that although there may be more negative pressure on Bitcoin in June, there will probably be a bounce back and subsequent increase.

However, a well-known market researcher named Ali Martinez has recently noted a discernible drop in investor interest in Bitcoin. As a result of this waning interest, Bitcoin’s price may fall much more, approaching $60,000.

Significant ETF withdrawals and lacklustre market performance have made investors warier of Bitcoin. Even though the market may briefly drop, some analysts are still bullish about Bitcoin’s long-term prospects and believe that it will rise again after this turbulent phase.

As of this writing, Bitcoin traded for over $64,300, a 0.3% decrease from its peak price. The flagship cryptocurrency has dropped to a low of $63,378.89 in the last 24 hours, and its one-day trading volume has fallen to $24.13 billion, a 7% decrease. However, throughout the four hours, the BTC Futures Open Interest increased by 0.43% to $5.50 billion, suggesting that investors may be starting to rebuild faith in cryptocurrencies.