The US Government Is Pursuing Tether

Garlinghouse claims that possible US action against the stablecoin issuer could cause a significant upheaval in the cryptocurrency industry.

“The US Government is going after Tether. That is clear to me. I view Tether as a very important part of the ecosystem and I don’t know how to predict the impact it would have on the rest of the ecosystem,” Garlinghouse said.

This assertion aligns with startling revelations concerning the utilization of USDT by sanctioned nations and terrorist organizations to circumvent US financial sanctions. Additionally, during his testimony before the Senate Banking Committee in April, US Treasury Deputy Secretary Adewale Adeyemo highlighted Russia’s growing reliance on cryptocurrency payments, particularly Tether’s USDT, as a means to evade economic sanctions.

“We’ve seen Russia increasingly turning to alternative payment mechanisms—including the stablecoin tether—to try to circumvent our sanctions and continue to finance its war machine,” Adeyemo wrote.

The extensive usage of cryptocurrencies for money laundering was revealed by a UN study simultaneously, with USDT on the TRON blockchain emerging as a critical vehicle, especially within illegal online gaming platforms.

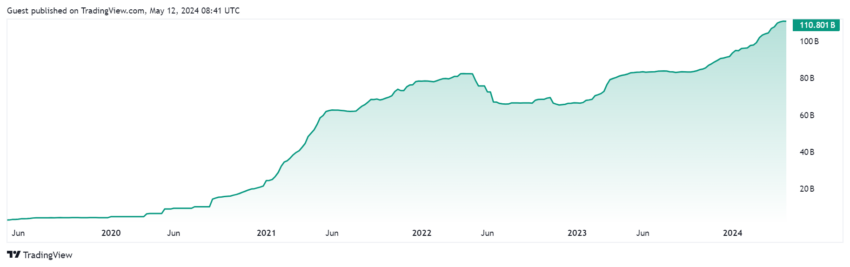

Market Cap for Tether USDT Stablecoin.

Despite these worries, Tether stresses its adherence to compliance rules and cooperation with law enforcement to prevent illicit financial operations. The business has taken proactive steps, freezing addresses containing a considerable number of tokens used for illegal purposes. Additionally, Tether’s USDT, boasting a circulating supply nearing $110 billion, remains the most valuable stablecoin by market value. Notably, the business recorded a record first-quarter net profit of $4.52 billion.

However, Ripple has joined the market despite the controversy surrounding the biggest stablecoin issuer. The business declared last month that it would launch its stablecoin.

“Ripple’s move into stablecoins isn’t just about innovation; it’s about contributing to the XRPL ecosystem and setting the stage for a more robust and diverse crypto landscape,” Ripple said.

“Ripple’s move into stablecoins isn’t just about innovation; it’s about contributing to the XRPL ecosystem and setting the stage for a more robust and diverse crypto landscape,” Ripple said.

Since the announcement, the business has not released any further information regarding the asset. Ripple’s CTO, David Schwartz, suggested that the stablecoin’s name be revealed in June.