The tokenization of real-world assets (RWAs) has surpassed key cryptocurrency sectors such as Ethereum (ETH) and Bitcoin (BTC) to become the most booming sector in the market.

Significant developments like well-publicized asset tokenizations and constructive regulatory conversations drive this upsurge. It also emphasizes how important and promising the sector is becoming for the financial industry.

Regulations and High-Profile Use Cases Strengthen the RWA Tokenization Industry

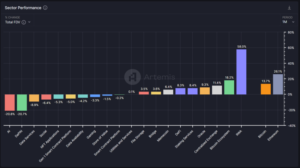

According to data from the crypto analytics platform Artemis Terminal, real-world asset tokenization performed 58% better than the other 21 crypto sectors last month. The ecosystems for Ethereum and Bitcoin came next, performing 26.1% and 18.2%, respectively.

Due to industry advancements, RWA tokenization has grown significantly in the last several years. On June 4, Galaxy Digital used a 316-year-old Stradivarius violin as collateral for a multimillion-dollar loan.

The digital version of the Stradivarius violin, as a non-fungible token (NFT), serves as security for the loan. This plan gives Galaxy Digital freedom in asset management while guaranteeing robust security. The violin is still in Hong Kong’s custody; taking it out would require special permission.

Watford Football Club (Watford FC) also started a digital equity sale that day. The sale includes a partnership with Republic, a digital investment platform, and offers about 10% of the company’s shares. Republic’s website and its European equivalent, Seedrs, will offer this stock offering.

Developments in regulations also aided the industry. A hearing titled “Next Generation Infrastructure: How Tokenization of Real-World Assets Will Facilitate Efficient Markets” was held on June 7 by the US Financial Services Committee. The hearing evaluated the necessity for additional legislation to facilitate tokenizing tangible assets and derivative products.

Prominent members of the industry attended the hearing. The real-world asset tokenization sector was represented by Robert Morgan, CEO of the USDF Consortium, and Carlos Domingo, co-founder and CEO of Securitize. The financial markets industry was represented by contributions from Lilya Tessler, Partner at Sidley Austin LLP, and Nadine Chakar, Global Head of Digital Assets at the Depository Trust and Clearing Corporation. Professor Hilary Allen of the American University Washington College of Law offered a scholarly viewpoint in the interim.

Even if lawmakers and witnesses had different points of view, the session brought attention to the ongoing discussion concerning blockchain technology in traditional finance. Such talks may clarify regulations, which could open the door to tokenization being used more widely.

The industry’s long-term outlook is still favorable. Regarding tokenization, BlackRock CEO Larry Fink has voiced hope.

He mentioned that it allows for immediate settlement of stocks and bonds and allows for customized strategies. Fink claims that these skills can drastically lower settlement expenses.

Franklin Templeton CEO Jenny Johnson also emphasized the game-changing possibilities of tokenizing physical assets. She cited instances like Rihanna’s NFT royalties and the St. Regis in Aspen’s loyalty programs.

“It’s this combination of loyalty programs with real-world assets, and I think that you’re going to see more and more companies do this combination. It’s simply that the technology is enabling you to do it,” she opined.

Johnson added that younger investors can now access professional asset management due to the decreased entry barriers and operating expenses associated with tokenizing assets, such as Franklin Templeton’s tokenized money market fund. She thinks that by enabling smaller, more manageable contributions, digital wallets will inspire younger people to save for retirement.

Johnson generally sees traditional financial institutions using blockchain technology more and more. Incorporating blockchain technology into standard investing procedures promotes younger generations’ savings habits and increases financial inclusion.