After a phenomenal surge in 2023 and early 2024, MicroStrategy, the largest corporate Bitcoin holder in the world, is now finding its way into the MSCI World Stock Index. Over the course of the previous year and the first part of 2024, MicroStrategy’s (NASDAQ: MSTR) share price has surpassed that of Bitcoin. Tuesday, May 14, saw a 4.15% increase in the cost of MSTR stock, trading slightly below $1,300.

The Inclusion of MicroStrategy in the MSCI Index: A Minor Gain for MSTR?

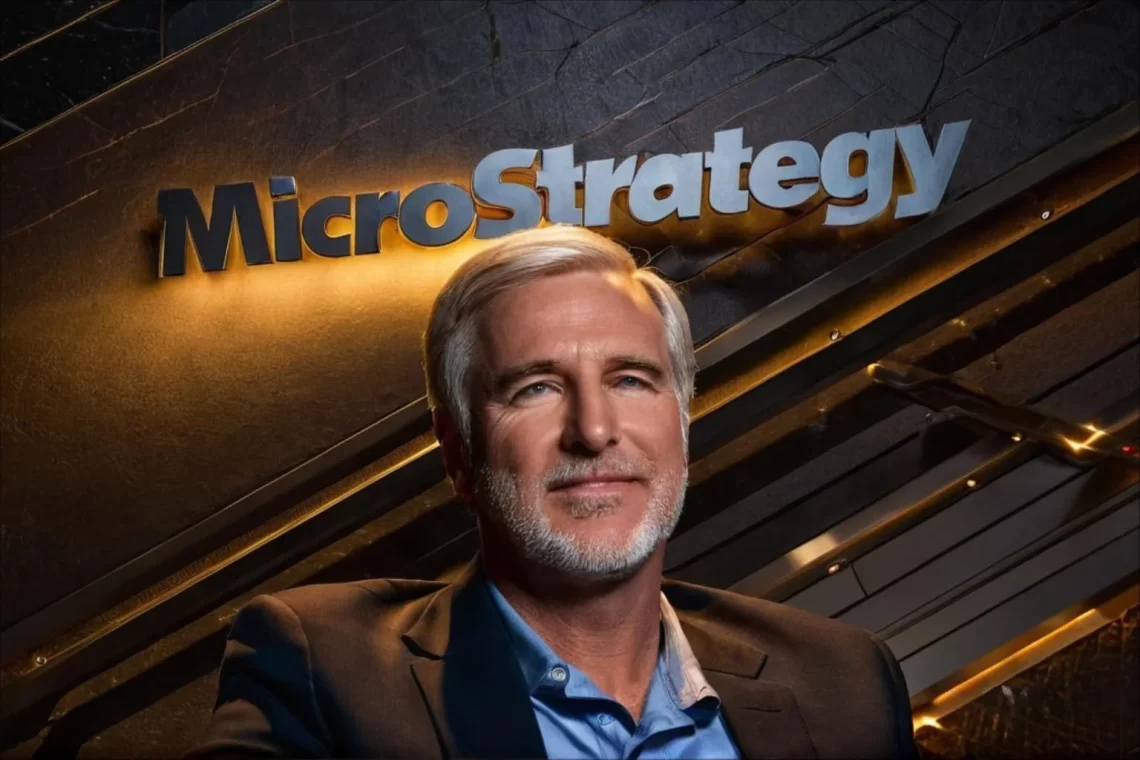

According to a statement released by MSCI Inc. on Tuesday, MicroStrategy, a well-known corporate software manufacturer, has emerged as one of the top three entrants to the MSCI World Index based on market capitalization.

This development demonstrates the rising incorporation of crypto exposure into standard investing portfolios. Companies like MicroStrategy highlight the increasing significance of bitcoin assets in investing strategies, with billions of dollars tracking or being benchmarked against MSCI’s global index.

In addition, new exchange-traded funds (ETFs) that hold digital assets directly are starting to appear in the U.S. and Hong Kong. Over time, these ETFs may draw interest from products similar to multi-asset funds.

Michael Saylor, a co-founder of MicroStrategy, is well-known for his support of Bitcoin. The corporation gained notoriety by investing a portion of its cash reserves in the initial cryptocurrency during the COVID-19 crisis. As of April 26, MicroStrategy had a sizeable holding of 214,400 Bitcoins.

Ahead for the MSTR Stock Rally?

MicroStrategy’s (MSTR) share price tripled last year, outpacing the Bitcoin price increase by an astounding 130%. The MSTR stock increased to $1919 earlier this year, coinciding with the Bitcoin price reaching its all-time high of $74,000. However, in a significant retreat during the previous month, it has retraced more than thirty percent.

Most MicroStrategy investors see it as a substitute for owning Bitcoin. However, the spot Bitcoin ETFs launched this year in the U.S. have challenged MicroStrategy’s market supremacy.

Kerrisdale Capital Management LLC stated in March that it had decided to short the stock due to its rapid growth exceeding the price increase of the digital asset. According to data from Bloomberg, MicroStrategy presently has four analyst buy ratings and an average 12-month price target of $1,678.75, approximately 30% higher than the stock’s current position.