After releasing the May CPI and PPI statistics, the U.S. Federal Reserve will announce interest rate choices this week, which are essential for Bitcoin (BTC) and the larger cryptocurrency market. As of the time of writing, the price of Bitcoin (BTC) is hovering at $69,500, having failed to hold above $71,000 the previous week.

What Can We Expect From a Fed Cut?

Last week, the European Union and the Bank of Canada decided to pursue monetary easing and lower interest rates. Nonetheless, several market observers think it improbable that the U.S. Federal Reserve will follow suit.

It is largely expected that the Federal Reserve’s policy-setting committee will keep the key fed funds rate in the current range of 5.25–5.50% when it concludes its two-day meeting on Wednesday. Since last July, this level—a 23-year high—has been in place to keep the pressure on inflation from rising.

The FedWatch Tool from the CME Group indicates that traders mainly anticipate the earliest rate cut in September. On Friday, traders lowered their wagers on a September rate decrease from 68.7% to 50.8%. This change came after a report from the Bureau of Labor Statistics showed the labour market doing better than expected in May, raising the possibility that rising salaries and employment growth were driving higher inflation.

Bitcoin (BTC) Future Price Movement

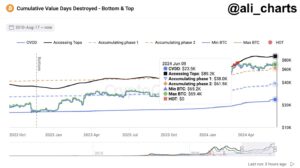

A well-known cryptocurrency analyst, Ali Martinez, predicted that Bitcoin’s value would rise significantly and reach a local top of $89,200. Martinez noticed the remarkable 730 rises in the Bitcoin Taker Buy Sell Ratio on HTX Global.

This significant buy pressure reflects a strong bullish feeling, suggesting that the price of Bitcoin may soon increase significantly.

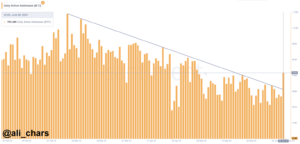

Martinez reports a notable increase in the Bitcoin network’s activity. The number of daily active Bitcoin addresses has broken a downward trend that started on March 5. 765,480 Bitcoin addresses were active during the previous day.

Martinez reports a notable increase in the Bitcoin network’s activity. The number of daily active Bitcoin addresses has broken a downward trend that started on March 5. 765,480 Bitcoin addresses were active during the previous day.

Martinez stressed that the increase in network activity is a sign of hope, implying that the present Bitcoin boom will probably last.