Ethereum Transfer Fees Have Dropped As The Network Has Frozen

Data from the on-chain analytics company Santiment indicates a noticeable decrease in Ethereum transaction costs lately. Here, “transaction fees” refer to the average fees (in USD) that senders are currently adding to their transfers on the ETH network.

The traffic patterns seen by the blockchain are often reflected in the value of this measure. The average rates typically increase as more customers move throughout the network.

The blockchain’s restricted processing capacity is the source of this, as it can choke the network during high activity and make transactions take a while to complete.

By attaching a hefty cost to their transfers, users who prefer to avoid the wait times prioritise the validators over other users. When many senders engage in such competitive behaviour, the average can rapidly increase, making block space increasingly valuable.

However, amid periods of low activity on the Ethereum blockchain, transaction fees might stay low because users would only have a little incentive to pay considerable fees.

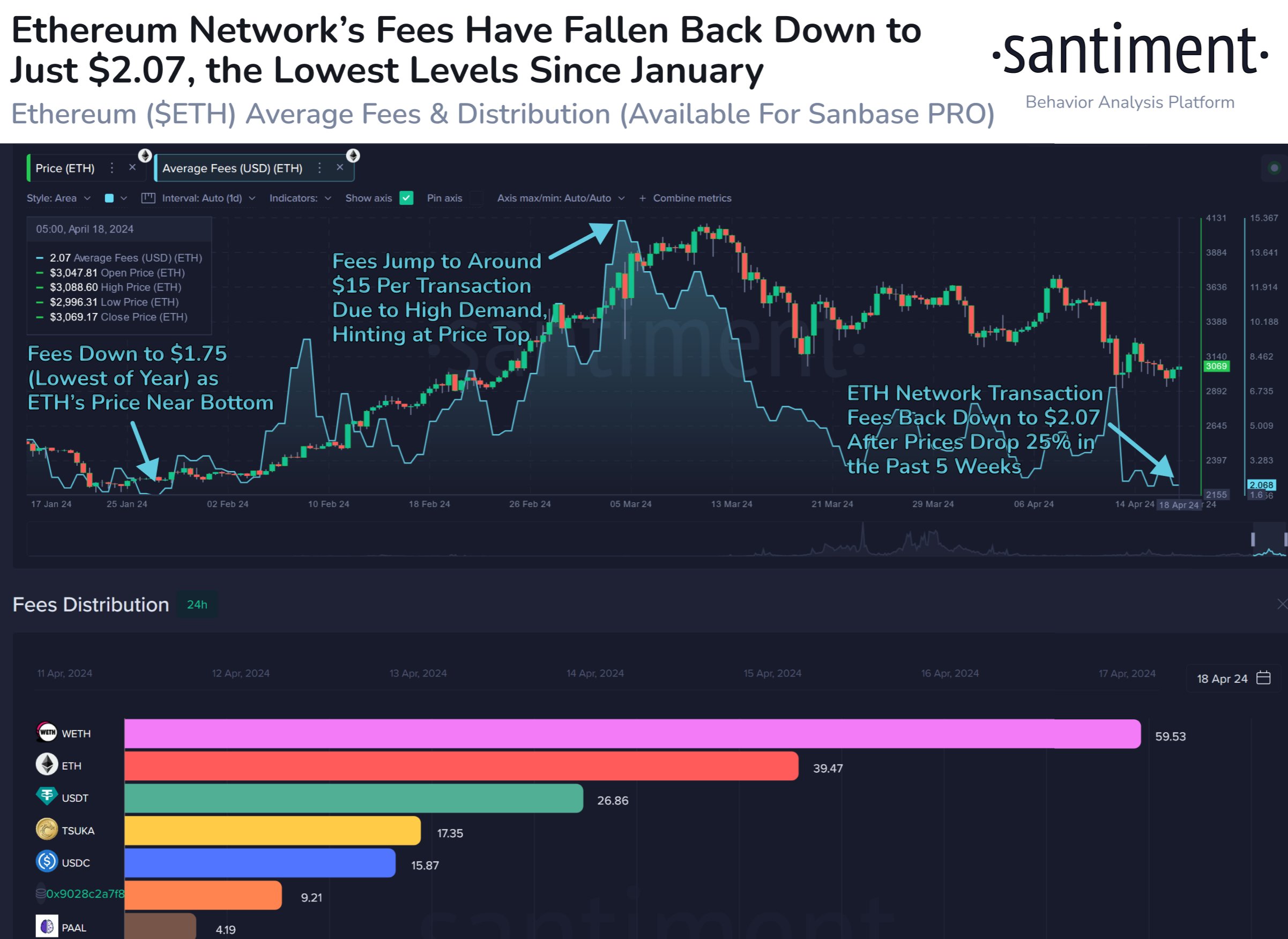

This graphic, which covers the previous few months, illustrates the trend in the average Ethereum fees:

Ethereum Average Charges

The graph above illustrates how Ethereum transaction fees have dropped recently to just $2.07. The indicator has not touched this low since January of this year.

The decrease in costs suggests no longer any network activity related to cryptocurrencies. Generally speaking, traffic and the atmosphere surrounding an asset are related. Santiment clarifies:

Transaction fees are generally an excellent way to track the market’s emotional cycles, which typically oscillate between the belief that cryptocurrency is “going to the moon” and “dead.”

A dearth of activity on the network implies that investors might not be interested in the coin right now. However, this might not affect the price of the asset.

The analytics company claims that low average fees typically correspond with Ethereum bottoms and that peaks in the metric could happen in tandem with top formations.

The graph indicates that when the fees had dropped as low as $1.75 in January, ETH’s price was almost at a minimum. Similarly, last month’s indicator peaked around $15 before the peak.

It is still being determined whether a similar pattern will emerge this time and whether Ethereum is about to reach a bottom.

Ethereum’s price, which had previously fallen below $2,900, appears to have recovered; it is now trading above $3,100.

Ethereum Chart Price

Santiment.net, TradingView.com, and Unsplash.com are the sources of the featured photograph from Kanchanara.