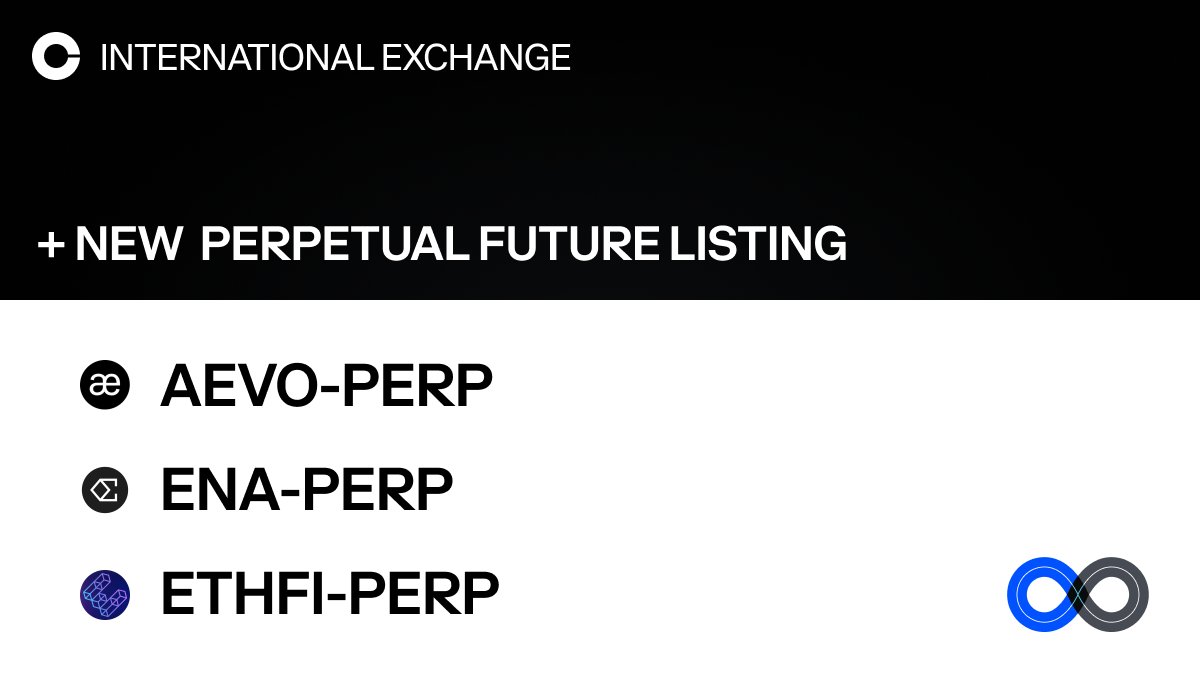

A well-known cryptocurrency exchange, Coinbase, has just made news about three well-known cryptocurrencies: AEVO, Ethena (ENA), and ether.fi (ETHFI). This announcement has given Coinbase significant traction in the market today. In light of the unstable market conditions, traders and enthusiasts eagerly await the potential impact on the prices of these assets, as the exchange’s announcement to list them on its platform has ignited speculation throughout the cryptocurrency market.

Coinbase’s Crypto Listing Sparks Speculation

The announcement by Coinbase International Exchange of the opening of the AEVO-PERP, ENA-PERP, and ETHFI-PERP markets has drawn interest from market players. These markets first went into a post-only mode, letting users submit and cancel limit orders without executing matches.

But soon after, Coinbase made these markets fully tradeable by allowing different orders, such as market, stop, limit, and stop limit orders. Support from well-known cryptocurrency exchanges, such as Coinbase, has historically positively impacted cryptocurrency prices.

Meanwhile, with the market prevailing in heightened volatility, investors and enthusiasts are closely monitoring the potential impact of Coinbase’s listing announcement on AEVO, Ethena (ENA), and ETHFI prices. Notably, this development underscores the significance of exchange listings as catalysts for price movements in the dynamic crypto landscape.

Examining the Possible Effect on Price

With the market still reacting to outside events, such as announcements from exchanges, the inclusion of AEVO, ENA, and ETHFI on Coinbase’s platform may indicate that these cryptocurrencies are seeing a bull run. The transition from post-only to full-trading mode signifies increased liquidity and trading opportunities for investors, potentially driving up demand and prices

Furthermore, Coinbase’s user base and reputation make it a significant participant in the cryptocurrency field, increasing its listings’ effect on sentiment in the market. Despite the inherent volatility of the cryptocurrency markets, listing AEVO, ENA, and ETHFI on the top exchange could give these assets new life and momentum and possibly lead to a price surge shortly.

At the time of writing, Ethena’s one-day trading volume had dropped 31.45% to $315.20 million, and its price was down 0.64% at $0.797. Amid the recent volatile scenario in the broader market, crypto has lost nearly 6% over the last seven days, while there has been a monthly gain of 39%.

On the other hand, the ETHFI price jumped 2.45% following Coinbase’s announcement and traded at $3.75, with its trading volume plummeting 28% to $249.33 million. The cryptocurrency has seen a high of $3.89 and a low of $3.48 in the past 24 hours.