Following the less-than-expected CPI data and indications of slowing inflation, the price of BTC attempted to breach above $70,000. However, the Bulls could not maintain the momentum, as at press time, BTC had dropped back to around $67,400. The silver lining, meanwhile, is that for the past week, Bitcoin whales have been adding significant amounts at each decline.

Bitcoin Whales: A Robust Stack

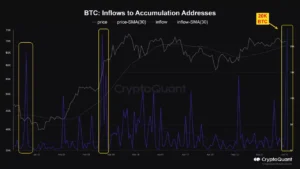

According to recent statistics from CryptoQuant, around 20,000 Bitcoins flooded into whale wallets after the market correction earlier this week. This demonstrates how big investors have been growing their holdings while taking advantage of every market decline.

Bitcoin whales have taken advantage of these market swings and the chance that BTC price corrections present to increase their holdings. On the other hand, as CoinGape revealed, BTC miners have started selling off their holdings to make up for the decline in their earnings following the halving. As a result, the price of Bitcoin has been under constant selling pressure.

Significant inflows into US Bitcoin ETFs occurred simultaneously over the previous three weeks. Inflows into the BTC ETF resumed after two days of net outflows earlier this week.

The spot Bitcoin ETFs saw a net inflow of $101 million on Wednesday, June 12. The Fidelity FBTC ETF is topping the chart with a daily inflow of $50.6 million, indicating that the Grayscale GBTC outflows have again stopped.

Supply of BTC Exchange Falls to Three-Month Low

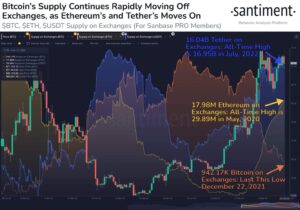

According to on-chain data source Santiment, for the first time in almost three years, since December 2021, the total number of Bitcoins available on exchanges has decreased from one million to 942,000.

Because there is less BTC available for sale, there is less chance of a major price decline, as seen by the reduced quantity of BTC on exchanges. Therefore, the limited availability of Bitcoin in exchange points to a more stable future for the larger cryptocurrency market.

Moreover, the short-term mood for BTC investments has increased by 55% since the introduction of the spot BTC ETFs earlier this year.

As of this writing, BTC is trading at $67,500. However, $67,000 is still a critical support level that needs to be broken to trigger a drop to $65,000 and then $62,500.