The bitcoin price is currently trading below the short-term average realized price of $62.6k, which was a crucial level of support during the bull market. Amidst the US PCE inflation data and quarterly options expiry laying the stage for market direction in the following days, traders are anticipating significant volatility. Will the price of Bitcoin fall below $55,000 or rise to $65k in the next few days?

Traders of Bitcoin Search for Cues

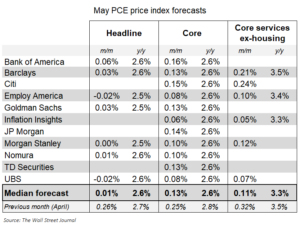

Though Wall Street behemoths like JPMorgan, Goldman Sachs, and Morgan Stanley expect inflation to moderate with the Fed rate cut beginning in September, the Federal Reserve’s preferred gauge to measure inflation, PCE and core PCE, came in line last month.

In the updated forecasts, all banks predict that headline PCE inflation will drop from 2.7% to 2.5%. Core PCE inflation will also decrease further, from 2.8% to 2.6%. Due to widespread belief that the Fed will drop interest rates when global inflation declines and will very likely join other central banks in doing so, markets have already begun to rise.

But on Thursday, Kristalina Georgieva, the managing director of the IMF, stated, “The Fed should keep policy rates at current levels until at least late 2024.” She said that the strong US economic growth continues to present upside risks to inflation. The robust US job market is the leading cause of the delay in rate decreases. Compared to the Fed, the IMF is more confident that the 2% goal rate will be reached by mid-2025, which is earlier than the Fed’s estimate for 2026.

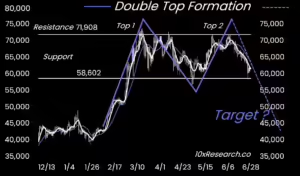

Analyst Predicts BTC Price Risk to Drop to $55,000

The CEO of the crypto market research company 10x Research, Markus Thielen, projects that the price of Bitcoin will fall below $55,000. He listed ten potential causes, such as the double top pattern in the price of Bitcoin, that may send it plummeting below $55,000.

A significant decline in Bitcoin’s price could also be caused by the weekly RSI falling in spite of investors buying the drop, a lack of institutional buying, as evidenced by spot Bitcoin ETFs, and increasing selling pressure brought on by macroeconomic factors.

In the meantime, the US dollar index (DXY), which was previously measured at 106.12 ahead of PCE, is currently down to 105.91. As US President Joe Biden and US President Donald Trump sparred in their first presidential debate, the yield on the US 10-year Treasury note surged beyond 4.3%. The DXY and Treasury yields move in the opposite direction of bitcoin, and the most recent statistics showed volatility and uncertainty.

Data from Bitcoin Options Indicates Buying Activity

According to CoinGape, whales selling their Bitcoin holdings and Long-Term Holders’ (LTH) on-chain data both indicate that there is now much pressure on the market.

However, according to Deribit, Bitcoin options statistics show a shift in the direction of recovery with an increase in call open interests. The IV of Bitcoin has remained relatively high despite the prominent market swings. The BTC is less than 50% for every critical term. Additionally, figures from CoinGlass show an overall rise in open interest in options.

As mood gradually improves, the launch of the Spot Ethereum ETF next could prevent a sharp decline in the price of BTC. Investors should watch for a rise in trading volumes, but it is difficult to expect a sharp rebound to $65k.

The price of bitcoin increased by 1% over the previous day to trade at $61,291. $60,561 is the 24-hour low, while $62,292 is the 24-hour high. In addition, trade volume increased by 3% over the past day.