According to on-chain data, The Bitcoin miners recently saw their second-highest revenue day in the cryptocurrency’s history.

Just Now, Bitcoin Miners Earned Almost $76 Million in Total Income

In a recent post on X, Julio Moreno, head of research at CryptoQuant, noted that daily total profits for Bitcoin miners have been approaching all-time highs.

“daily revenue” refers to a metric representing the total money that Bitcoin miners earn daily from transaction fees and block rewards (expressed in USD).

When miners solve blocks on the network, they are paid with block rewards; when they handle individual transactions, they are produced with transaction fees.

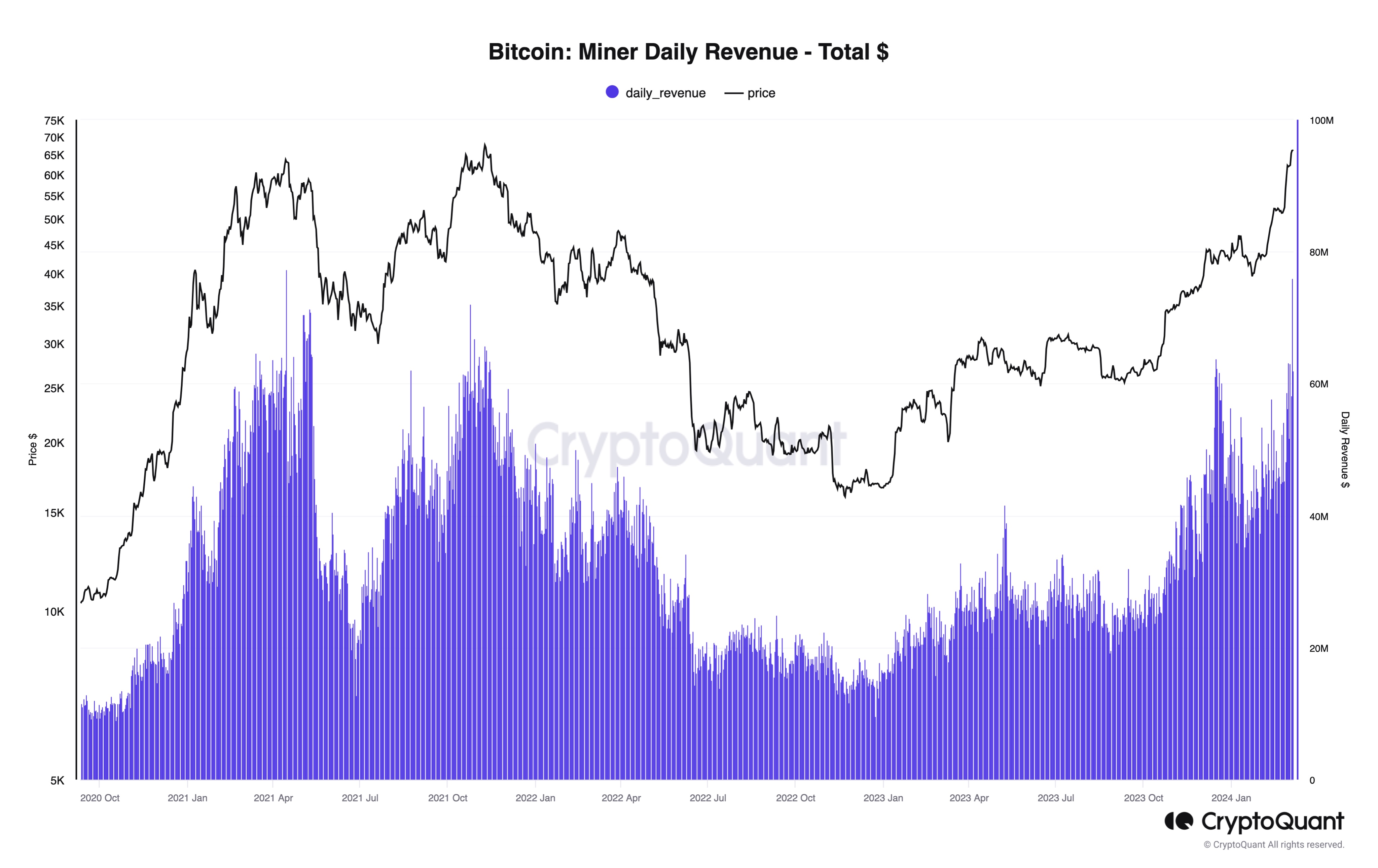

Here is a graph that illustrates the pattern of daily earnings for Bitcoin miners over the previous several years:

Revenue from Bitcoin Miners

As seen in the graph above, there has been a significant increase in Bitcoin miner revenue lately. The miners made $75.9 million in a single day with this surge.

This was not too dissimilar from the metric’s all-time high of $77.3 million, reached in April 2021. Except for this record itself, this most recent increase was more significant than any spike seen during the cryptocurrency’s entire history.

What is the cause of this sudden increase in Bitcoin miner earnings, then? The chart indicates that the primary impetus would have been the Bitcoin rally to an all-time high.

However, the two parts of the overall miner revenue have different effects from the rally. Any price increase for the block rewards has a linear impact because the USD worth of these awards increases with the price rise.

The recent dramatic increase in the value of Bitcoin makes it not surprising that the block rewards have likewise increased in value. But the relationship is more complicated when it comes to the transaction fees.

The total fees are based on how much traffic flows through the blockchain. During rallies, traffic does tend to increase as more people become interested in cryptocurrencies, which drives up network fees.

However, how much activity a rally would bring to the blockchain is not always obvious. In addition, demand for a network application such as the Inscriptions is one of the additional, frequently more powerful elements that might influence the transaction costs.

According to data from YCharts, the transaction fees have significantly increased with the most recent surge, but the absolute value hasn’t been too high.

Transaction Fees for Bitcoin

There were nearly $7 million in transaction fees on the day of the most recent revenue surge. But this only accounted for slightly more than 10% of the entire income. Therefore, the primary cause of the recent rise in Bitcoin miner earnings has been the block rewards.

Although miners are making a lot of money, the next halving is set for next month, during which their block rewards will be permanently cut in half.

Bitcoin miners may soon see a sharp decline in their earnings due to the present block-reward-heavy business model. This is unless the price can maintain its steep trajectory to make up for it or whether transaction fees can somehow rise to close the gap.

Bitcoin Value

As of this writing, Bitcoin has increased in value by 7% over the previous week to trade at over $67,100.