Data suggesting that BTC miners may be about to capitulate has caused a stir in the cryptocurrency market, marking a first for the industry. On-chain insights for today, June 25, showed a significant decline in miners’ OTC BTC sales, suggesting that the market may be about to recover.

After Bitcoin’s halving this year, mining profits drastically decreased, which affected miner activity. Many miners sold Bitcoin, mostly to pay for their operating expenses.

The post-halving period saw extremely high volatility in Bitcoin’s price, which is consistent with the factor indicated above. On the other hand, new on-chain data offer some optimism for upcoming market movements.

The Selling Pressure of Miners Drops

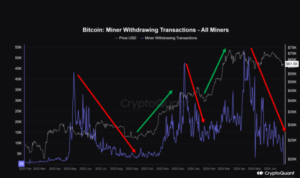

The on-chain insights that CryptoQuant has simplified show that miners’ BTC sales have significantly decreased since May of this year. This indicates that selling pressure on Bitcoin has less effect, fostering positive market sentiment.

Notably, a possible upward momentum route appears if the market can effectively absorb the entire volume of miners’ sales. According to CryptoQuant’s projections, the third quarter of this year will demonstrate this positive outlook.

It’s also important to remember that since May, the price of Bitcoin has been moving horizontally. Nonetheless, a bullish path for BTC price action seems with the waning selling pressure.

Performance of the Bitcoin Market

As of the time of writing, Bitcoin’s price had increased by 0.96% to $61,357.47. This price spike occurs in the context of three days in a row of BTC ETF inflows.

On the other hand, BTC Futures OI dropped 1.56% to $31.56 billion, highlighting some volatility. Meanwhile, the volume of derivatives increased by 9.32% to $42.48 billion.

The RSI for Bitcoin went along 35, confirming the market’s erratic behaviour with downward pressure. However, if the token moves into an oversold area, there could be a price bounce.

Moreover, the market is teeming with hope for an upswing momentum because today is the expiration date for BTC options. On the other hand, it’s also important to remember that the United States and German governments are rumoured to have sold off enormous quantities of BTC, which could lend some mystery to future price movements.