Aside from a recovery in cryptocurrency market optimism, a few additional indicators point to the probability of a bull run. Following weeks of a neutral stance, market sentiment has recently shifted to greed. Furthermore, there has been a considerable price increase in cryptocurrencies such as Bitcoin.

This article will examine the five most obvious signals that Bull Run will arrive early.

Bitcoin Market Dominance

Bitcoin’s price has recently recovered significantly, trading around $67,146.49. It is only 9% away from the ATH of $73,750.07; if the trend continues, prices may rise much further. According to Tradingview data, Bitcoin dominance has increased to 55.87%, the highest level in three years, indicating the start of an early bull run. It is because historical data suggests that the crypto bull run started when Bitcoin’s dominance soared by more than 56%.

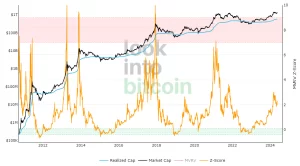

Bitcoin MVRV Z-score

According to the LookIntoBitcoin charts, the Bitcoin MVRV Z score indicates the cycle’s peak by comparing the current Bitcoin capitalization to its historical average value. The top score for this comparison is roughly 6; Bitcoin data is currently halfway there. Bitcoin’s MVRV Z score has been far from 6 since the 2021 bull run.

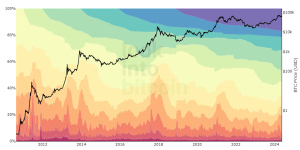

Bitcoin HODL Waves.

After analyzing new and old BTC holders, the Bitcoin HODL waves data shows that Bitcoin is bullish. As the number of new BTC holders has decreased, there is a prospect of further gains as selling pressure eases. New holders are likelier to sell when conditions become unfavourable, or they see short-term gains.

RHODL Ratio

The RHODL ratio compares newly purchased BTC to BTC purchased a year or two earlier. According to current data, Bitcoin buyers are paying more for their BTC than they did two years ago, which indicates that the market has reached peak levels.

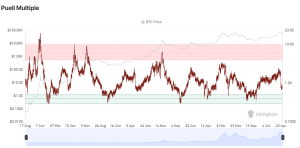

Puell Multiple Levels

The Puelle multiple represents the gap between short-term BTC miner revenue and long-term revenue patterns. Typically, a peak occurs when the level reaches 3; the highest level this year was 2.5 in March. At the time of writing, it is less than one, having dropped in response to Bitcoin’s halving. The value is rising, which will contribute to the bull market.

According to TLDR crypto analyst ELI5, miners make good money when Puell levels are high, which corresponds to cycle tops. He claims that “the previous cycles had two spikes.” Now that we’ve finished the first one, it appears that one more step is required before reaching the top.

Final Thought

The bull run for cryptocurrency offers the most significant benefits to the market, but it is not a one-day event because it takes a considerable market push. As the cryptocurrency market has suffered for weeks, investors are looking to the crypto bull run rise to offset their losses. However, the bull run is expected to begin by the end of the year and continue until mid-2025. However, a few on-chain indicators and crypto analysts, including ELI5 of TLDR, have predicted an earlier favourable situation as the market prepares.