In the cryptocurrency market, meme currencies rise as macroeconomic conditions improve, building on a general upswing. Following periods of market volatility during which assets lost tokens, the US Consumer Price Index (CPI) announcement turned the tide.

In times of high interest rates, investors tend to shift their funds away from riskier assets, and meme coins are considered more dangerous. Declining inflation could imply a future rate drop by the Federal Reserve, increasing the performance of meme coins. As of publication, the market capitalization of meme coins has increased by 1% to $56.5 billion, with some assets exhibiting a 100X potential. Here are three meme coins with 100X potential today.

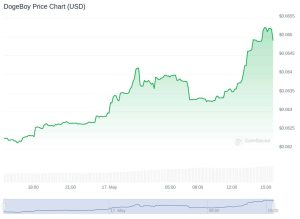

DogeBoy (DOGB)

With 117% of all meme coin inflows throughout the asset recovery, DogeBoy is currently the biggest meme coin gainer. The project’s market cap increased over a two-week surge of 149%. As reported by days from CoinGecko, the asset’s daily trading volume is $191,481. Although this is a deficient number, it might ignite a more significant rise.

As investors pour money into relatively new projects that yield over 100X gains, DOGB is rising.

Pepe Trump (PTRUMP)

Pepe Trump is currently up 74.5% on the market, trading at 0.006444. Weekly flows for the asset are also up 12.9% as funds flow to new projects. The asset’s name, which combines Pepe and Trump, is one of the main talking points around it. Memes such as PEPE saw incredible market growth, bringing its market capitalization over $4.2 billion, making it the third largest meme coin in the world, behind Dogecoin and Shiba Inu.

Trump has impacted the market with his recent remarks ahead of the US Presidential election and the introduction of meme currencies like BODEN.

AMATERASU OMIKAMI (OMIKAMI)

As meme coins surge, the asset has increased by 266% and 60.8% over the past seven days. Analysts say this implies a potential for a 100X should bulls maintain their dominance. Recent flows into cryptocurrency assets will increase depending on the Fed’s decisions about interest rates.