Today’s increases in the cryptocurrency market are being led by Solana (SOL) and Cardano (ADA), two of the top cryptocurrencies. This follows precipitous withdrawals that caused Bitcoin and other cryptocurrency values to plummet even further. Today, the market capitalization has increased by 3.35% to $2.28 trillion. With significant institutional inflows, the value was over $2.6 trillion before the price fell.

The community nicknamed her. As the broader gains momentum, ETH killers Solana and Cardano saw inflows in the past 24 hours. Decentralized finance (DeFi) tokens and meme currencies saw increases as well. Solana affects DeFi operations and volumes as a top smart contract blockchain.

Solana Exceeds Principal Assets

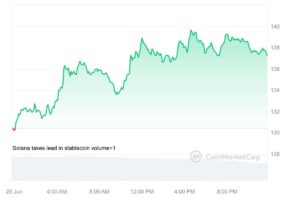

Over the last few years, Solana has established a reputation for beating out premium assets when the market is recovering. SOL is up 5.98% today, surpassing weekly outflows by a wide margin. Weekly data is currently in positive territory, with the asset valued at $137.73. The 30-day numbers, however, are down 17% and indicate prior losses.

As daily trading volumes dropped to $2.5 billion, Solana’s market capitalization surged to $63.5 billion. Bulls predicted a fresh price run, but the price of SOL crashed through numerous resistance levels. The asset may move up on the rebound to recapture previously reached levels. According to DeFiLlama, the total value locked on Solana at publication is $4.25 billion, up 6.44% over the previous day. DeFi volumes are increasing in tandem with the market’s increased activity.

Cardano Adheres to SOL

Cardano is trading at $0.3932, gaining 4.5% the previous day to offset some losses. With a 3.2% increase in weekly statistics, ADA’s market capitalization reached $14 billion. Updates to the network continue to be a key asset driver despite current macro conditions. Even if ADA’s long-term gains fell, institutional investors believe this year’s interest rate drop will be a bullish catalyst. Other cryptocurrency assets, such as Ethereum (ETH) and Bitcoin (BTC), saw rises.