An on-chain indicator’s data indicates that most altcoins have now entered the historical “danger zone,” which could be a bearish indication.

Altcoin Alert: Trader Profits Signal Potential Overbought Territory!

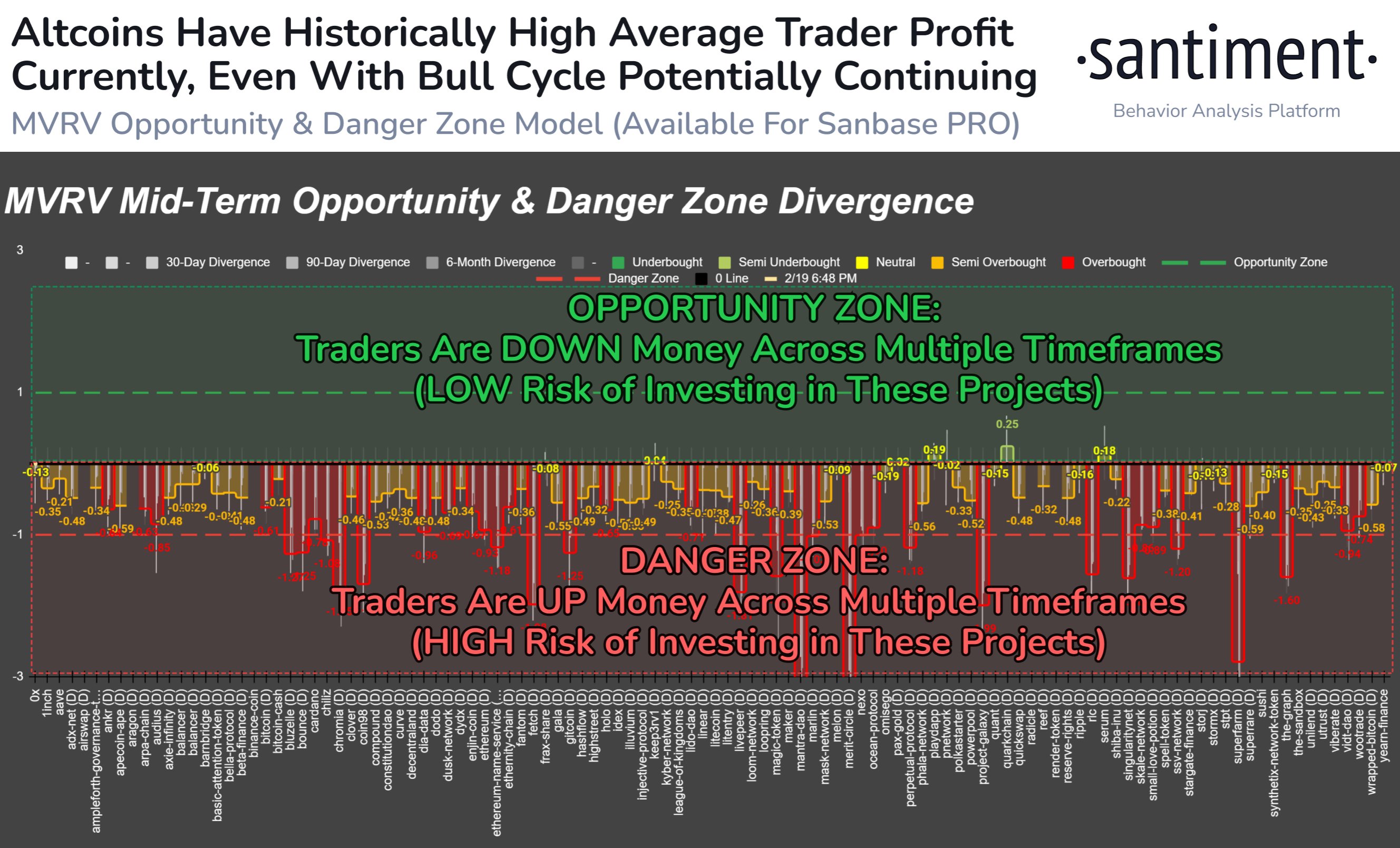

The on-chain analytics company Santiment talked about how the MVRV ratio of altcoins shows that they have recently seen high profits in a new post on X.

The “Market Value to Realized Value (MVRV) ratio” is an indicator that tracks a cryptocurrency’s market capitalization compared to its realized capitalization. In the “realized cap” model, a token’s value is determined by its last movement on the blockchain, not its current spot price.

Price = Cost for Most Tokens: Last purchase often sets cost basis, making realized price the effective market benchmark.

MVRV Measures Market Sentiment: MVRV ratio compares value investors hold (market cap) to what they paid (realized cap), revealing buy/sell signals.

Profit Triggers: Historically, high MVRV (profit) meant overvalued assets, while low MVRV (loss) meant underpriced opportunities.

MVRV Zones Guide Trades: Based on past trends, Santiment defines “opportunity” and “danger” zones for MVRV, helping investors navigate market sentiment.

The chart below displays the divergence of the MVRV ratio for various altcoins and timeframes.

Assessing Altcoin Profitability with Santiment’s MVRV Model

Santiment’s data suggests a potential storm brewing in the altcoin market. Their MVRV model, which tracks how much profit traders are carrying, identifies most altcoins as being in the “danger zone.” This means many investors hold significant gains, potentially leading to sell-offs if the market dips.

Altcoin warning: Profits soar, “overbought” signal flashes! Don’t panic, crashes aren’t sure bets. But history says: caution during long bull runs, especially with high profit indicators like MVRV. Tread carefully with altcoins, especially risky moonshots!

However, Santiment doesn’t paint a doomsday picture. They simply advise caution, highlighting the increased risk attached to entering new positions or buying at current prices. While a correction isn’t guaranteed, the data suggests investors should be extra vigilant about their altcoin strategies, especially those targeting “moon shots” on less established projects.

Remember, the market can be unpredictable, and even the most respected metrics can miss unexpected turns. However, by understanding the MVRV danger zone and its historical correlation with price fluctuations, investors can make more informed decisions and potentially mitigate risk, regardless of whether a correction materializes or not.

ETH Value

Ethereum and Bitcoin have recently separated, with Ethereum experiencing a new high above $2,900 and the original cryptocurrency falling sideways.

Shutterstock.com featured images, TradingView.com charts, and Santiment.net charts.