The well-known cryptocurrency Cardano (ADA) has had an incredible rise today. Because of the recent spike, the price of ADA has risen above $0.48. This means that Cardano addresses with $2.71 billion worth of tokens in total have now broken even, having previously experienced losses as a result of the ongoing drops.

Cardano Talks About Reaching Break Even

Finally, according to on-chain data provided by Into The Block, the Cardano addresses that bought ADA at an average price of $0.47 have broken even. Consequently, these assets will turn a profit if there is another surge. Furthermore, many predict Cardano is ready for a rebound because the ADA/BTC ratio recently hit its lowest point.

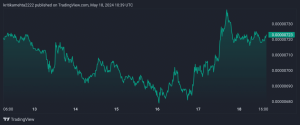

In a recent market report on X, renowned cryptocurrency analyst Sebastian outlined encouraging indicators for Cardano relative to Bitcoin (BTC). According to Sebastian, the ADA/BTC chart has bottomed out, suggesting a possible bullish turnaround. According to Trading View, the pair bottomed out on Thursday, May 16, at 0.00000680. The ADA/BTC pair then showed signs of recovery.

Furthermore, it increased by 0.28% to 0.00000723 over 24 hours. The expert also noted the existence of bullish divergence. This technical signal implies that the downtrend may be tapering off and that the price of Cardano may be about to rise.

The analyst highlighted a significant resistance level that was established above 0.0000079. Sebastian thinks that ADA might start an extended rally if it can break above this resistance, making it an excellent option for investors trying to maximise returns. “This is the ideal time to switch from Bitcoin to ADA and catch the next wave,” he suggested. This means that in the foreseeable future, Cardano might do better than Bitcoin.

Price increases for ADA

Today, the price of Cardano reached a high of $0.4899, closing in on $0.49. On Saturday, May 18, at the time of writing, the cost of ADA was up 1.21% to $0.4862. On the other hand, ADA’s 24-hour trading volume fell 24.31% to $327.18 million. At that time, the cryptocurrency’s market value was $17.31 billion.

As to Coinglass data, the open interest for Cardano futures was steady at $289.77 million. As the price of ADA rose, short sellers took the lead in the liquidations. As a result, on the last day, ADA short liquidations totalled $282.66, more than three times the amount of ADA long liquidations.

These brief liquidations may raise the price of Cardano before a dump occurs. The 10-day EMA of 0.46 is currently less than the ADA value, which suggests a short-term bullish attitude. However, the long-term trend has been bearish since the cryptocurrency trades are below the 200-day and 100-day EMAs, which are 0.507 and 0.525, respectively.