A potential stall in EV markets could be detrimental to blockchain performance.

The EV industry will likely see an improvement in consumer convenience and usability with the integration of blockchain-based technology.

However, blockchain’s expansion into multiple other customer segments can limit the volatility in one particular segment.

There is much room for growth in the blockchain industry in the short term. The sector, expected to generate over $94.0 billion in revenue by the end of 2027, will have catered to a wide range of customers and sectors. However, the disadvantage for one of the biggest potential customers in the market may keep pressure on the expansion potential. A likely stall in EV markets could be detrimental to blockchain’s performance.

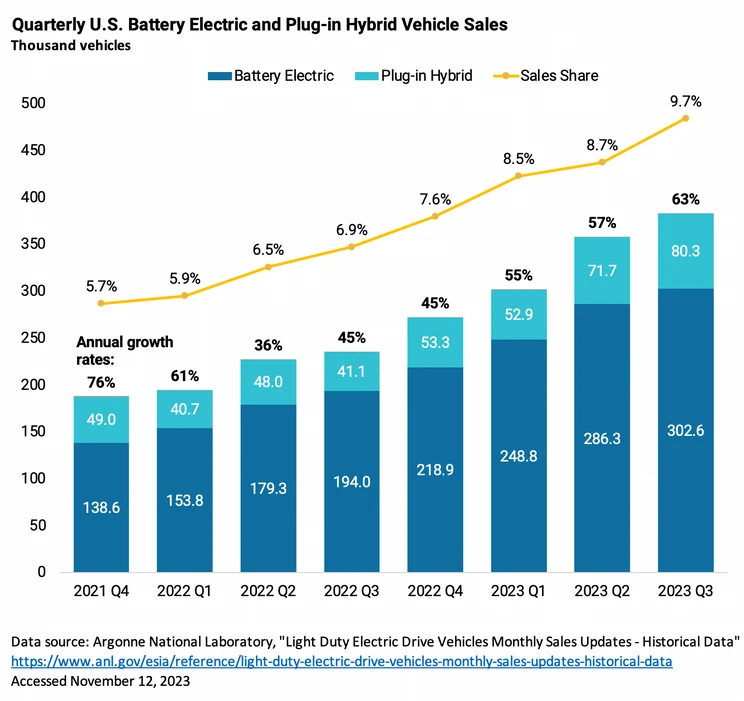

EV Markets Are Growing Slowly

In an interview with Yahoo Finance, lead equities analyst at RBC Capital Markets, Tom Narayan, says that the EV markets are growing slowly. Although demand isn’t declining in the markets, the rate at which it is rising should raise some concerns.

The depressing results released by industry giants can be used to analyze the precarious situation of EVs. Tesla’s fourth-quarter earnings were slightly lower than projected by analysts. The business declared 71 cents in adjusted earnings per share. Analysts predicted that the company would generate an average EPS of 74 cents.

Blockchain’s Major Clients: EVs on the Rise

The electric vehicle (EV) industry uses blockchain in many different ways. Forbes predicts that most cars of the future will unavoidably be electric. The EV industry will likely see an improvement in consumer convenience and usability with the integration of blockchain-based technology. It can be challenging to own an EV for two main reasons. The high initial cost of the vehicles is one factor, while the lack of charging stations is another. Blockchain technology provides an answer to these problems with electric car operation. Furthermore, blockchain-based websites, apps, and notification systems allow electric vehicle users to find, locate, and utilize charging stations. EV companies can be used to keep an eye on the materials they import and manage global production.

According to McKinsey research, blockchain technology can offer the foundation for complex networks that control sales, distribution, trade, and payment processing. Utilizing blockchain technology and smart contracts can expedite and reduce transaction costs, reducing pain points and friction along the entire power value chain.

Blockchain Industry Forecast: What Can We Expect?

From 2023 to 2030, the blockchain technology market is expected to expand at a compound annual growth rate (CAGR) of 87.7%. The market was projected to be valued at $17.46 billion in 2023. The increasing demand for safe and transparent transactions across multiple industries expands the market.

A downturn in EV markets could lead to a significant portion of revenue and a decline in blockchain customers, given the much higher expected growth. However, blockchain’s expansion into several other customer segments, such as financial institutions, oil and gas, international trade, etc., can limit the volatility in one market.