The Curve DAO (CRV) price unexpectedly dropped by about 30%, sending shockwaves through the cryptocurrency community. The token fell from a high of $0.35 to a low of $0.27 due to huge liquidations that created a chain reaction of negative occurrences. According to data from many on-chain platforms, Michael Egorov, the founder of Curve Finance, is liquidating millions of CRV Price tokens on various DeFi platforms amid this meltdown. This comes after Arkham disclosed an impending $140 million CRV liquidation.

CRV Disposition & Pessimistic Trend

Arkham’s June 12 post on X mentioned that $140 million in CRV Price liquidations were approaching soon in the cryptocurrency space. Accordingly, Michael Egorov, the founder of Curve, has borrowed $95.7 million in stablecoins, primarily crvUSD, against his $141 million CRV spread over five accounts on five different protocols. According to Arkham, the founder looks to be spending $60 million a year simply to maintain his roles at Llamalend.

According to data from PeckshieldAlert, a Michael Egorov-branded address has previously liquidated 20.2 million CRV on UwU Lend, another DeFi protocol, using the liquidation “sifuvision. eth.” In addition, a whale address, 0xF078…0f19E, was noted as liquidating 29.6 million CRV Price today amid the over 30% decline in CRV prices. During this price collapse, Lookonchain’s insights highlighted a trader’s 10.58 million CRV liquidation on Fraxlend.

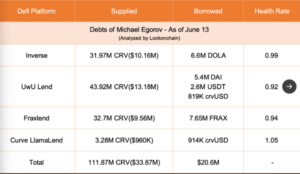

Meanwhile, Lookonchain’s data showed that Egorov was holding $20.6 million in debt on four defi platforms—UwU Lend, Fraxlend, Curve LlamaLend, and Inverse—as well as 111.87 million CRV in collateral.

Price Action for CRV

As of this writing, the value of the CRV token has dropped dramatically by 20.39% to $0.2778. The coin’s 24-hour high and low values are $0.3742 and $0.2236, respectively.

Notably, Ki Young Ju, the CEO of CryptoQuant, has again taken to X to highlight the noteworthy rise in the CRV balance on exchanges within the previously mentioned frightening story. In the later hours of June 13, the exchange balance spiked 57%, reaching an all-time high. As the exchange supply increases, the downward pressure on the token on the market increases.

Nevertheless, Coinglass data showed that investors’ interest in the asset was demonstrated by a 108.32% growth in the token’s Futures OI to $105.65 million and a 472.96% increase in derivatives volume to $1.33 billion, despite the issues above.