Fred Krueger, a supporter of Bitcoin, recently expressed worries about the underlying trends of Ethereum (ETH) and possible regulatory obstacles. In a post on X, Krueger emphasized some noteworthy data about Ethereum’s transactional utility and network activity.

Ethereum Declining Utility Raises Concerns.

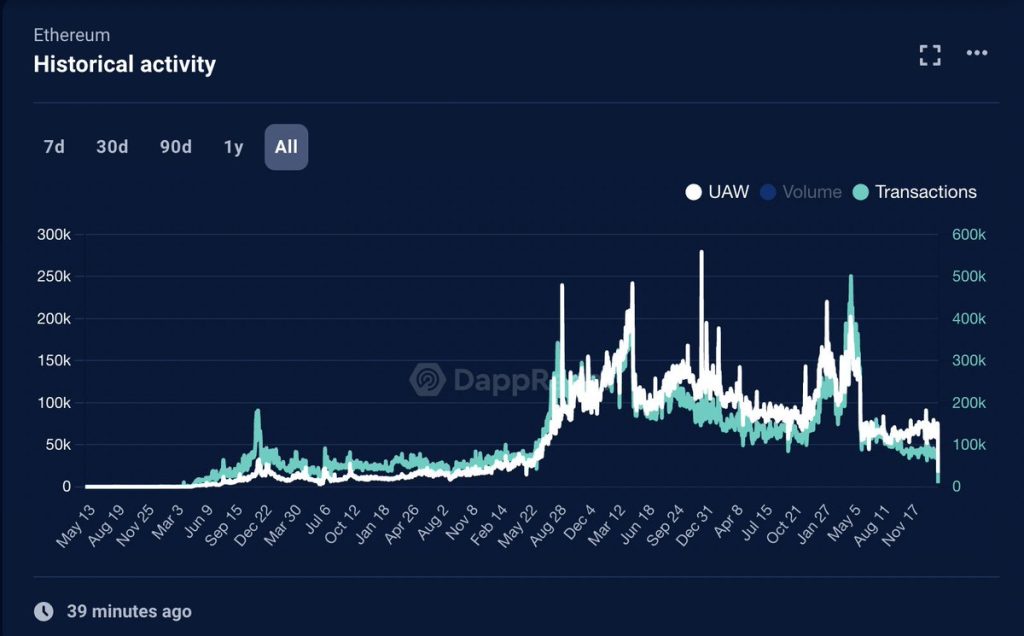

In his criticism, Krueger emphasized Ethereum’s recent two-year peak and the declining network usage that accompanied it. Even though ETH hit $3,000, Krueger observed that Daily Active Users (DAUs) fell sharply from 120,000 in 2021 to just 66,000 in the previous year.

The decrease in user activity on Uniswap V3, Ethereum’s top decentralized exchange protocol and the blockchain’s “top app” was also brought to Bitcoin Maxi’s attention and noted as a noteworthy concern.

Krueger pointed out:

Uniswap V3, the leading app, is only receiving 16K DAUs. I recall that this figure was at least 60K in 2020. It is undeniably true that ETH is no longer directly utilized as a chain.

Additionally, Krueger sharply compared Ethereum’s present state and a “meme coin,” pointing out parallels between assets like Shiba Inu (SHIB).

Krueger pointed out that despite Ethereum’s strong price performance, observers perceive a decline in its usefulness compared to other blockchain networks like Solana, Avalanche, and Near.

The Bitcoin Maxi went on to say:

Naturally, this doesn’t deter investors from raising its market capitalization to $361 billion. It has truly evolved into a meme coin, much like Shiba Inu. It could be more swift ($1.50 per transaction) and inexpensive. If you’re all interested in gaming reward points or casino-style DeFi apps, Solana, Avalanche, Near, and other such apps are fantastic.

Regulatory Uncertainty And The Response Of The Community

Beyond Ethereum’s practical applications, Krueger also criticized the platform’s regulatory future. Citing worries about regulatory scrutiny, he voiced doubts about the likelihood of a spot Ethereum Exchange-Traded Fund (ETF) approval:

And last, Gensler will not approve of an ETF for ETH. Enjoy yourself if you think the Tooth Fairy exists. Gary doesn’t want to heavily pre-mine his second ETF. Creates a disastrous precedent.

At the end, the Bitcoin Maxi said, “Avoid ETH at all costs.” Despite Krueger’s analysis, the ETH community continues to have faith in ETH. Numerous comments refuting Krueger’s statement in his post were found.

In a comment on Krueger’s post, an X user going by the handle “n o k a” noted that Ethereum’s roadmap is centered on scalability using a modular and rollup-centric methodology. They contend that evaluating Daily Active Users (DAU) on the main net alone is misleading, much like valuing Bitcoin only based on its primary net usage.

“But you [Fred Krueger] discredit yourself here,” they said, despite their agreement that was portraying Ethereum as sound money “was/is clownish.”

Over the past year, even L2s like Arbitrum have decreased.

That things are okay in ETH-land is untrue pic.twitter.com/oOIPwyCrj2.

— Fred Krueger, February 21, 2024 (@dotkrueger)

A different user named “John Doe” notes a noticeable drop in total value locked (TVL) across the DeFi space. This suggests that users of decentralized finance (DeFi) are generally lowering their risk tolerance before possibly reinvesting in the future.

Even though you are highly regarded in the ETF industry, Sir, you need to understand how Defi Cycles operate. Look at Defillama and compare the TVL charts from the previous bull run to the ones from today. Throughout the area, there has been a noticeable drop. Degens are reducing the risk before we are in once more.

— February 21, 2024, John Doe (@h0dlboi)